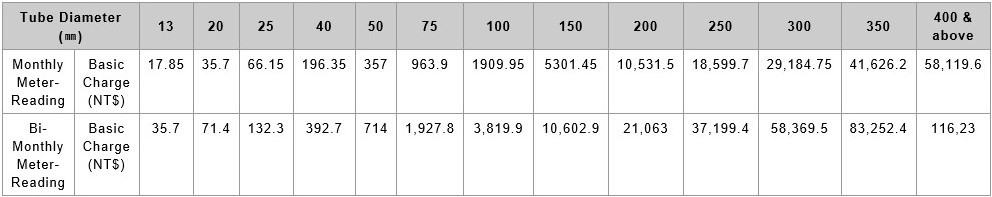

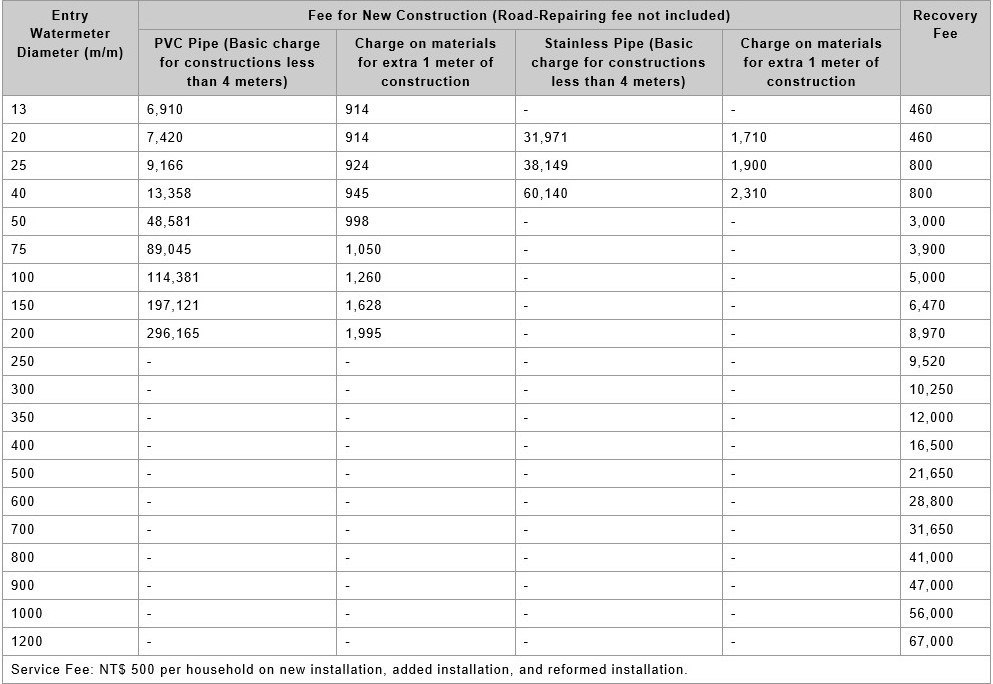

Meter Reading

Basic Charges of Different Tube Diameters (include the business tax)

Date: 2021/11/12

Basic Charges of Different Tube Diameters (include the business tax)

Basic Charges of Different Tube Diameters (include the business tax)

Remarks:

1.Formula of calculating water consumption fee, business tax, cleaning fee,

water Resources conservation and compensation fee:

(1)Basic Charge = The basic charges according to the tube diameters listed

above

(2)Water Consumption Fee = (Unit Price × Exact Consumption - Progressed

Difference)

(3)Business Tax = (Basic Charge + Water Consumption Fee )÷(1+5%)× 5% .

According to laws & regulations, for domestic consumers, this tax is included

into the water consumption fee column without being additionally listed

(4)Cleaning Fee = Unit Price verified by environmental protection authorities for

burying or incinerating measures × Exact Consumption (Rounded off if

containing amount less than NT$ 1)

(5)Water Resources Conservation and Compensation Fee (Collected on

commission)=Water Consumption Fee (Business Tax not included)×

Surcharge Rate 5%(Rounded off if containing amount less than NT$ 1)

2. A domestic consumer should pay fees including basic charge, water

consumption fee, business tax, and cleaning fee or sewage disposal fee.

3. A 50% discount is given to public facility and raw water consumption fee.

4. An extra 50% of total fee should be paid by temporary consumption.

5. An extra 20% of total fee should be paid if temporary consumption is made by

illegal constructions.

6.For junior high schools and elementary schools, the basic charge needs to be

paid according to the table above, the exact consumption is paid according to

the unit price listed in the 1st phase column.

7. None of the phased prices includes the business tax.

8. The total water fee is calculated to NT$, any amount less than NT$ 1 is

rounded off.

1.Formula of calculating water consumption fee, business tax, cleaning fee,

water Resources conservation and compensation fee:

(1)Basic Charge = The basic charges according to the tube diameters listed

above

(2)Water Consumption Fee = (Unit Price × Exact Consumption - Progressed

Difference)

(3)Business Tax = (Basic Charge + Water Consumption Fee )÷(1+5%)× 5% .

According to laws & regulations, for domestic consumers, this tax is included

into the water consumption fee column without being additionally listed

(4)Cleaning Fee = Unit Price verified by environmental protection authorities for

burying or incinerating measures × Exact Consumption (Rounded off if

containing amount less than NT$ 1)

(5)Water Resources Conservation and Compensation Fee (Collected on

commission)=Water Consumption Fee (Business Tax not included)×

Surcharge Rate 5%(Rounded off if containing amount less than NT$ 1)

2. A domestic consumer should pay fees including basic charge, water

consumption fee, business tax, and cleaning fee or sewage disposal fee.

3. A 50% discount is given to public facility and raw water consumption fee.

4. An extra 50% of total fee should be paid by temporary consumption.

5. An extra 20% of total fee should be paid if temporary consumption is made by

illegal constructions.

6.For junior high schools and elementary schools, the basic charge needs to be

paid according to the table above, the exact consumption is paid according to

the unit price listed in the 1st phase column.

7. None of the phased prices includes the business tax.

8. The total water fee is calculated to NT$, any amount less than NT$ 1 is

rounded off.

Basic Charges of Different Tube Diameters (include the business tax)

Basic Charges of Different Tube Diameters (include the business tax)